Overview

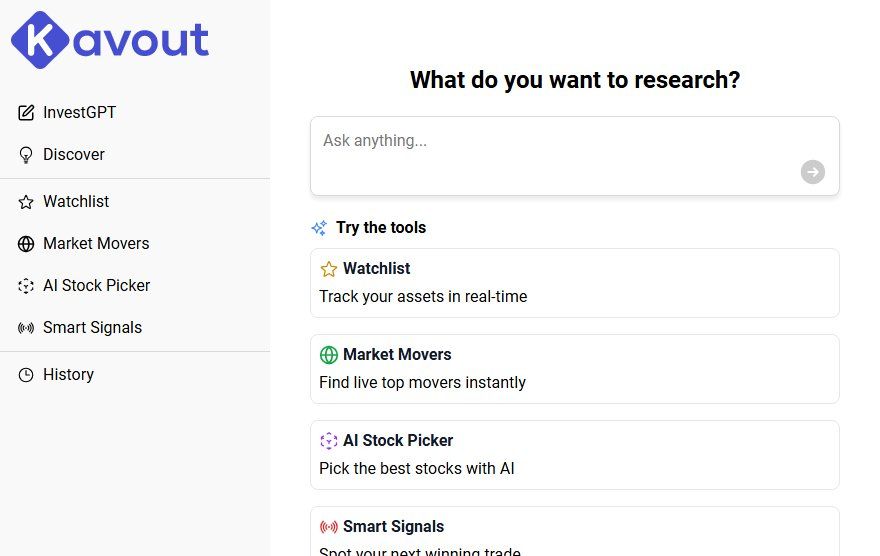

Kavout is a powerful AI-driven platform tailored for investors seeking to navigate the complexities of stocks and cryptocurrencies with confidence. Leveraging advanced NLP technology, it offers a suite of intelligent tools like the AI Stock Picker, which identifies high-potential stocks, and InvestGPT, delivering actionable investment insights in plain language. Whether you’re tracking real-time trading signals, analyzing stocks with the Kai Score, or staying ahead of market trends with Market Movers, Kavout transforms raw data into strategic opportunities. It’s designed for both seasoned traders and newcomers who want to make informed, data-backed decisions without drowning in spreadsheets or guesswork.

Beyond crunching numbers, Kavout acts as a conversational assistant, simplifying investment research through intuitive interactions. Imagine having a virtual analyst on call—ready to explain market movements, highlight emerging opportunities, or rank stocks based on robust AI analysis. Its real-time alerts and dynamic scoring systems ensure users never miss a beat in fast-moving markets. By blending deep research capabilities with user-friendly insights, Kavout demystifies investing, turning complexity into clarity and helping users unlock high-growth potential with ease.

Key Features

- AI Stock Picker for identifying high-potential stocks

- InvestGPT for AI-driven investment insights

- Real-time trading signals and alerts

- Kai Score for stock ranking and analysis

- Market Movers tracking top gainers/losers

- Smart Signals for trade opportunity detection

- Watchlist for real-time asset tracking

- Technical indicators for market scanning

- Dividend-focused ETF analysis tools

- Pro version with advanced features

Use Cases

Market Research and Trend Analysis

Kavout leverages advanced AI to analyze vast datasets, identifying emerging market trends and providing actionable insights. By processing financial reports, news articles, and social media sentiment, the tool helps researchers uncover patterns and make data-driven decisions. Its predictive analytics capabilities enable users to stay ahead of industry shifts and competitor movements, streamlining the research process.

Financial Data Interpretation

Kavout simplifies complex financial data by extracting key metrics, generating summaries, and highlighting anomalies. The tool can parse earnings reports, balance sheets, and SEC filings, transforming raw numbers into digestible insights. Its AI-driven analysis helps investors and analysts quickly assess company performance, identify risks, and spot opportunities without manual data crunching.

Real-Time Conversational Support

Kavout acts as an intelligent assistant, answering user queries in natural language with context-aware responses. Whether clarifying research methodologies, explaining financial terms, or providing quick data snapshots, the tool delivers instant, accurate assistance. Its conversational interface makes it easy for users to interact with complex datasets without technical expertise.

Competitive Intelligence Gathering

The tool automates competitor monitoring by tracking public data, news mentions, and market positioning. Kavout’s AI synthesizes information across multiple sources to provide comprehensive competitive landscapes, benchmarking analyses, and SWOT insights. This enables businesses to make strategic decisions based on up-to-date competitor intelligence.

Investment Thesis Validation

Kavout assists investors in testing hypotheses by cross-referencing investment ideas against historical patterns, market data, and economic indicators. The tool can simulate scenarios, assess risk factors, and provide probabilistic outcomes, helping users validate or refine their investment strategies before committing capital.

Target Audience & Industries

Target Audience

Kavout serves businesses and individuals seeking data-driven insights to enhance decision-making. Businesses benefit from predictive analytics and AI-powered tools to optimize operations, identify growth opportunities, and mitigate risks. Individuals, such as investors and analysts, gain access to advanced stock screening, portfolio optimization, and market trend analysis, enabling smarter financial choices. The tool empowers users with actionable intelligence, saving time and improving accuracy in their respective fields.

Target Industries

Industries that benefit most from Kavout include finance, investment management, and trading, where real-time data analysis and predictive modeling are critical. The technology sector leverages AI-driven insights for competitive research and innovation. Healthcare and pharmaceuticals use it for market trends and R&D optimization. Additionally, retail and e-commerce benefit from customer behavior analysis and inventory forecasting. Kavout’s versatility makes it valuable across any industry reliant on data-driven strategies.

Evaluation and Review

Advantages

- AI-Driven Stock Selection: Leverages advanced NLP and AI to identify high-potential stocks, saving time and improving accuracy in investment decisions.

- Real-Time Market Insights: Provides up-to-date trading signals, alerts, and top gainers/losers tracking for timely and informed trading actions.

- Comprehensive Stock Analysis: Uses Kai Score and technical indicators to rank and analyze stocks, offering a holistic view of market opportunities.

- Conversational Investment Assistance: Features InvestGPT for AI-driven insights and answers, simplifying complex market research through natural language interactions.

- Dividend and ETF Focus: Includes specialized tools for dividend-focused ETF analysis, catering to income-oriented investors.

- Customizable Watchlists: Enables real-time tracking of preferred assets, helping users stay updated on their investments effortlessly.

Limitations

- Dependence on historical data: AI-driven insights may rely heavily on past performance, which doesn’t always predict future market behavior accurately.

- Market volatility impact: Real-time signals and alerts may be less effective during highly unpredictable or extreme market conditions.

- Learning curve for beginners: Advanced features like technical indicators or Pro tools may require some financial knowledge to use effectively.

- Potential for over-reliance: Users might risk depending too much on AI recommendations without conducting their own due diligence.

Other Information

Domain Info

Created at: 2015-02-18

Expires at: 2026-02-18

Interest over time

Worldwide. Past 90 days. Web Search.